¿Qué tipo de flores escoger para un difunto? Novedosos tipos de flores para difuntos y funerales A la llegada del Día de

More¡Revolución Hogareña a Bajo Costo! Descubre la Casa Prefabricada y Móvil que es Furor en Amazon 🏠✨ Descubre la Casa Prefabricada y

MoreTransforma tu refugio: Ideas inspiradoras, como decorar tu dormitorio. Unas cuantas Ideas Geniales 🛏️✨ Buenos días, soy Johnny Zuri y HOY quiero

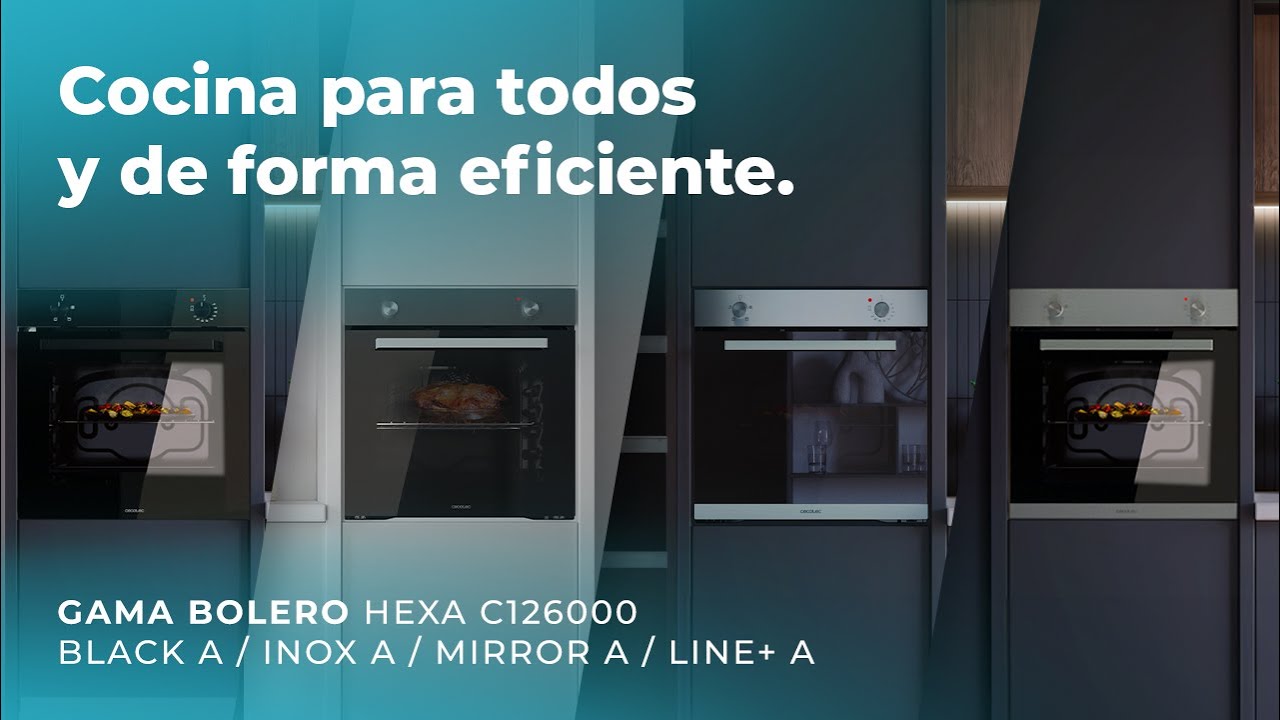

MoreHornos Bolero Hexa: Innovación y Eficiencia en tu Cocina – Revoluciona tu Cocina con Tecnología de Vanguardia. La cocina moderna demanda electrodomésticos

MoreSistemas de Tuberías Innovadores: Revolucionando el Futuro del Hogar 🚀💧 Tipos y Avances Tecnológicos 🏡🌍. En la vanguardia de la innovación y

MoreLas floristerías del futuro ¿Están las floristerías preparadas para las tendencias futuristas y vintage? En la era de la digitalización, la conexión

MoreDescubriendo las Maravillas de Floret Originals. Floret Originals: Un Viaje por el Mundo de las Semillas Únicas. Buenos días, soy Johnny Zuri

MoreMagia Floral y decoración con flores: Cómo Transformar tu Evento con una Decoración de Flores Exquisita. La decoración del 2024 nos invita

MoreDecoración Futurista en el Mundo: Un Vistazo al Futuro del Diseño de Interiores. El Impacto Visual de la Arquitectura Futurista En el

MoreLos mocasines son zapatos cómodos, versátiles y de diseño atemporal que han sido apreciados por diferentes culturas a lo largo de la

MoreLa iluminación adecuada en la habitación de un niño no solo es fundamental para su bienestar y desarrollo, sino que también puede

MoreSan Valentín es una fecha en la que las parejas aprovechan para demostrar todo su amor y cariño. Entre las diversas opciones

MoreRetro Elegancia en la Cocina: Tostadoras con Estilo La Fusión del Pasado y el Futuro en Electrodomésticos. El auge de lo retrofuturista

MoreHogares Smart: La Revolución del Confort y la Tecnología en el Hogar 🏡🤖 Innovación y Futuro en el Confort Doméstico 🚀 El

MoreSumérgete en el Lujo: Innovaciones en Piscinas Prefabricadas para Espacios Compactos. Innovación y Estilo. Innovación y Estilo en Espacios Reducidos El mundo

MoreRenovación de Cocinas en Zurilandia: Tradición y Tecnología en el Corazón del Hogar Transforma tu Cocina en Zurilandia | Ideas Innovadoras y

MoreLos Mejores Ventiladores de Mesa Pequeños y Silenciosos para tu Espacio de Trabajo Ventilador de Mesa Pequeño y Silencioso: Guía de Compra.

MoreDecore Cuenca: Trucos para transformar tu hogar sin romper tu contrato de alquiler… Conozca algunos trucos de decoración sin infringir su contrato

MoreDesentrañando el Encanto de las Bodas Temáticas y Vintage: Una Revolución Floral y Vintage🌸🎩 La magia que envuelve las Bodas Temáticas ha

MoreDescubre las Lámparas de Pie Nordicas que Transformarán tu Espacio. 🛋️ ¡Ilumina con estilo! 🌟 Descubrir el encanto de una lampara de

More5 cosas que Debes Saber sobre Sujeciones de Hormigón Prefabricado. 🌟 ¿El Futuro de la Construcción? En el mundo de la construcción,

More¿Vuelve Prisunic a Revolucionar la Decoración Vintage? 🌟 Prisunic: El regreso más esperado en el mundo de la “DECORACIÓN” 🌟 ¿Qué sorpresas

More¿El Estilo Japandi es el Futuro del Diseño de Interiores? 🌸🏯 Descubre el futuro del diseño de interiores con el estilo Japandi

More¡Descubre los Azulejos para Piscinas Modernas que Revolucionarán tu Verano! 🌊🌞 Descubre las tendencias. En el mundo de las piscinas, cada detalle

MoreMadera Curvada al Vapor: El Secreto Detrás de la Silla PK15 de Poul Kjærholm 🌳🛋️ Descubre cómo la madera curvada al vapor

MoreArquitectos para restaurantes: La revolución futurista y vintage del diseño de espacios gastronómicos 🍽️🏗️ Arquitectos para restaurantes: Cómo el diseño arquitectónico está

MoreBricolaje y Decoración. 🎨🖌️🎨 Pinturas y Brochas para Decoración Vintage y Flores en Cuenca 🌸 En el mundo del bricolaje y la

MoreTipos de piscinas modernas: Descubre el futuro del lujo y la decoración. El Lujo Futurista en Agua… Tipos de Piscinas Modernas: El

MoreLas uñas semipermanentes de Semilac son la solución perfecta para quienes desean lucir unas uñas impecables sin tener que preocuparse por los retoques constantes.

More¿Cómo el diseño futurista está revolucionando las casas experimentales? De la Innovación al Diseño Futurista. En la vasta intersección entre la tecnología

MoreVariedades de uva de mesa sin semilla. ¿Tu propio vino con la mejor uva? ¡Descubre Viveros Barber! En el universo vitivinícola, una

More¿Cuál es el Mejor Calzado para Jardinería? ¿Un fabricante de calzado de seguridad para jardinería? El cuidado y embellecimiento de los espacios

More